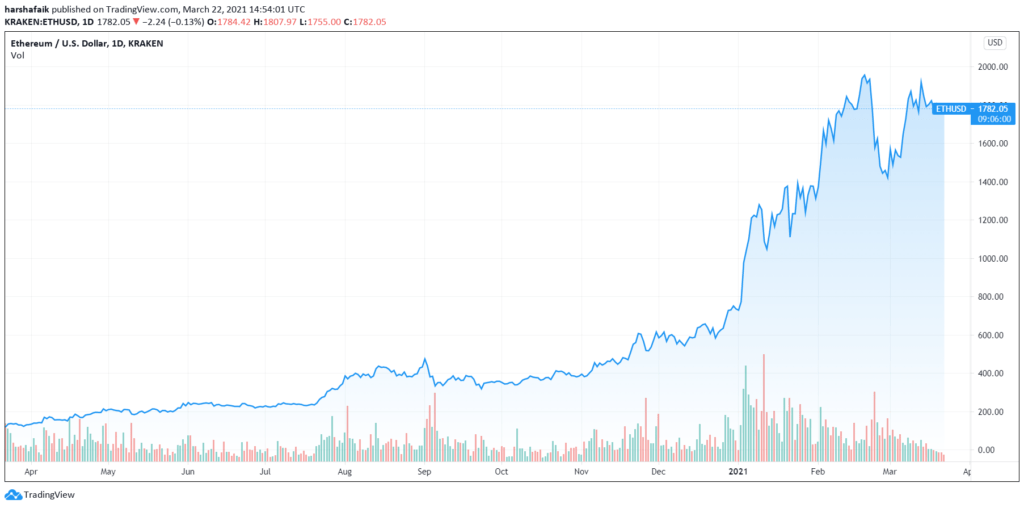

It’s a no-brainer that for the past few months, users of Ethereum are facing issues like rising gas fees and network congestions. This is in part due to the surge in Ethereum prices, which went to as high as $1940 before settling at around $1700.

All this has made the gas prices spike too with the example of summer last year. Thus, at a time when DeFi started to surge, ETH’s network fees were more than double at one point.

Thus, while linked directly to ETH’s increasing value, it also marks the growing demand for ERC-20 tokens, stablecoins as well as other DeFi based offerings in general.

Ethereum network is crowded due to the introduction of multitude of DeFi systems.

Also, with the advent of NFTs now, ETH’s transaction costs will continue to surge in the future. To combat this, a viable solution has to be implemented soon. This has to be done in a brisk manner since the crypto community no longer wants to wait till the proof-of-stake and ETH 2.0 transition is complete. Also, the community is aware of the alternative ecosystems where the number of developers and other users is increasing gradually.

There are myriad of options available which basically involve integrating different versions of Tether like USDT and USDC. Tron, a popular stablecoin is increasingly being used due to its quick transactions at a fraction of the cost.

People are optimistic about the scaling operations of Ethereum. Jack O’ Holleran, CEO of Skale Labs, a P-o-s network, believes that the issue of rising gas fees will be taken care of as scaling efforts continue to be worked on. He added:

“The Ethereum main net will evolve into a base layer of security and settlement. Scalability layers will sit on top of Ethereum, providing functionality for smart contract execution and low gas fees. We will also see the rise of application-specific blockchains, which provide more price efficiencies with greater predictability.“

What about the Berlin upgrade?

Ethereum community recently laid out its timeline for implementation of the “Berlin” upgrade. It is expected to go live at block 12,244,000 on 14th April.

EIPs like EIP-2565 seeking to reduce the cost of the ModExp precompile helping in calculating the gas cost; EIP-2929 that will “increase” gas costs under certain conditions; EIP-2718 that’ll introduce a new transaction module and lastly EIP-2930 which includes a transaction type with option access lists.

What about EIP-1559?

Although these EIPs aim to rectify current issues, the most anticipated upgrade to the network is EIP-1559, slated to go live in July. This will directly aim to fix the numerous issues faced with the Ethereum network. At first, it will redirect Ethereum’s native gas fee to the network itself instead of the miners. The fee will then be burned allowing gradual reduction in the total supply of the altcoin.

While on paper, it looks like a welcome change, miners aren’t pleased with this particular EIP. It is expected to reduce reward ratios by 50% as per rough estimates. Since the margin for reward is squeezed out at such levels, many mining pools have advocated for a network takeover – potentially threatening the security of the network.

Although things looks promising for the Ethereum community to solve its current issues, only time will tell if these EIPs are able to deliver a solution that is welcomed by all in a speedy manner.