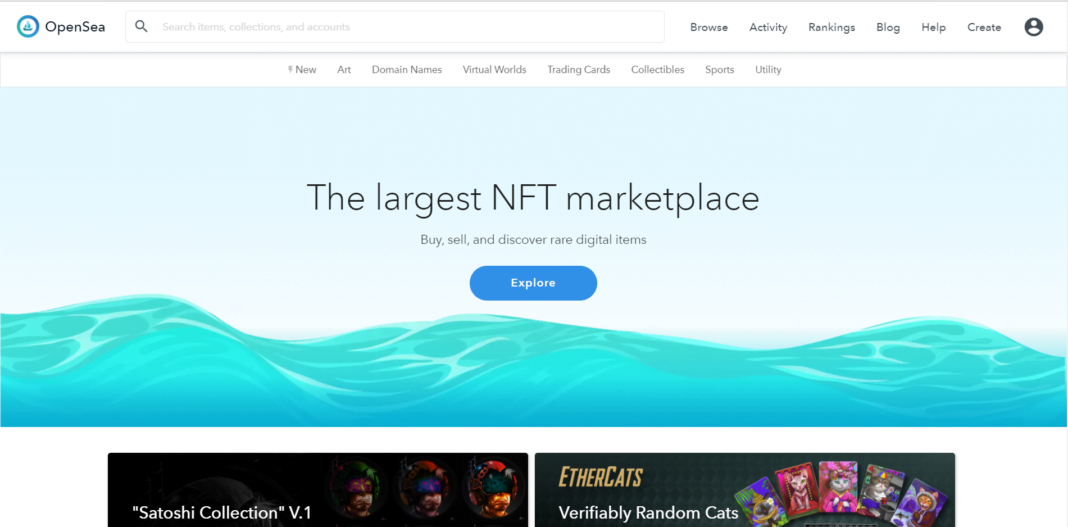

“Neitherconfirm”, A crypto artist had recently listed 26 NFTs on OpenSea’s digital marketplace. After a while though, the artist changes the images associated with each token from computer-generated portraits to photos of literal carpets.

The art piece has featured people and animal faces in stained-glass style. But now its nothing more than rugs, rugs and rugs! A clear example of why you can’t trust value proposition of any asset that maintains even a small aspect of centralized control.

Neitherconfirm asserted that its useless to talk about the value of NFTs if the token is not inseparable from the asset itself. He further added,

“What is the meaning of creating an unforgeable token on a highly secured network if somebody can alter, relink or destroy your possession? As long as the value of your artwork is reliable on a central service you do not own anything.”

If you take a look at the artist’s rugs, although they look similar, the price disparity further validates his claims. As of writing, the top bid for many NFTs was $1, while one was listed for $139 quadrillion!! I don’t think I need to explain how much higher that is than probably any monetary thing you’ve heard about.

Although the artist’s identity is unknown, he stated that his full-time job is “making sculptural art” under a top-selling artist. He further said that his pieces are sold for more than $10 million regularly.

It is unclear whether the artist made unique computer-generated rug images or found pictures of carpets online & turned them into NFTs. But he proved his point and gave a example of the grave concerns around NFTs. Even though the blockchain network is very secure, if NFTs’ properties can be altered in such a manner that can totally change the asset they own, that could become a widespread scam. It’ll taint the image of NFTs and result in losses for a lot of individuals.

Moreover, it could destroy liquidity across networks and essentially put the system on a standstill. To combat this, an authentication and verification system should be set ensuring that every token up for sale has a valid asset attached to it while being one of its own. Also, the marketplaces should have provisions for setting up clauses for tokens ensuring that after being sold, they can’t be altered either by the owner or by the seller. It shouldn’t be mandatory but provisions could be made. This will further boost the trust factor regarding tokens.